The Markets

Even the smartest guy in the room sometimes makes mistakes.

Jamie Dimon, CEO of the huge U.S. bank JP Morgan, has been

called the smartest guy in the room for his ability to effectively steer the

bank through the economic crisis. And, while most of the other big U.S. banks

have tarnished reputations, Dimon’s firm was the one that stood out from the

crowd.

Unfortunately, that all changed last week.

In a hastily arranged conference call with investors, Dimon

revealed that the bank lost $2 billion in just the past six weeks on “bets

aimed at shielding the bank from the market fallout of Europe's deepening mess,”

according to The Wall Street Journal.

These “bets” lost money due to “unusual movements in the relationships between

various derivative indexes focused on investment-grade and junk-bond corporate

debt, both in the U.S. and Europe,” according to the Journal.

This debacle points to three important investment lessons:

1. Keep it simple.

Trading fancy derivatives or using complex black box trading strategies might

give you an air of sophistication, but it may also lead to your downfall. As

Leonardo da Vinci said, “Simplicity is the ultimate sophistication.”

2. Pick and track your investments closely.

In describing the trades that blew up, Dimon said, “The new strategy was

flawed, complex, poorly reviewed, poorly executed, and poorly monitored,”

according to Bloomberg. Clearly, in this ever-changing world, a “set it and

forget it” investment strategy won’t cut it.

3.

Be

humble. Even a smart guy like Dimon can trip up. One of the biggest

errors in investing is self-deception – thinking and acting like you are the

smartest guy in the room. It’s better to worry about what could go wrong – and

plan for it – than think you’re invincible.

The investment landscape is littered with formerly sharp

investors who forgot these three lessons. We plan on keeping them front and

center.

Data as of 5/11/12

|

1-Week

|

Y-T-D

|

1-Year

|

3-Year

|

5-Year

|

10-Year

|

|

Standard

& Poor's 500 (Domestic Stocks)

|

-1.2%

|

7.6%

|

1.2%

|

14.2%

|

-1.9%

|

2.5%

|

|

DJ

Global ex US (Foreign Stocks)

|

-2.9

|

3.5

|

-17.1

|

7.0

|

-6.1

|

4.6

|

|

10-year

Treasury Note (Yield Only)

|

1.8

|

N/A

|

3.2

|

3.2

|

4.7

|

5.1

|

|

Gold

(per ounce)

|

-3.7

|

0.5

|

5.0

|

20.1

|

18.8

|

17.7

|

|

DJ-UBS

Commodity Index

|

-1.7

|

-4.2

|

-15.6

|

3.8

|

-4.9

|

3.0

|

|

DJ

Equity All REIT TR Index

|

0.6

|

13.6

|

10.4

|

30.7

|

0.4

|

10.8

|

Notes: S&P 500, DJ Global ex US,

Gold, DJ-UBS Commodity Index returns exclude reinvested dividends (gold does

not pay a dividend) and the three-, five-, and 10-year returns are annualized;

the DJ Equity All REIT TR Index does include reinvested dividends and the

three-, five-, and 10-year returns are annualized; and the 10-year Treasury

Note is simply the yield at the close of the day on each of the historical time

periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London

Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested

into directly. N/A means not applicable.

DOES IT MAKE SENSE that

a painting sells for $120 million in this economic environment?

You may have seen the recent headline that Edvard Munch’s

painting, “The Scream,” sold for a record-breaking $120 million. It made us

wonder what the implications are of an anonymous bidder forking over that kind

of cash for a pastel on canvas just three years out from a horrible economic

crisis. Does this mean happy days are here again?

Placed in broad context, the high sale price for a work of

art might be symptomatic of policymakers’ response to the economic crisis,

according to The Wall Street Journal.

When the economy began collapsing in 2008, governments around the world

responded by cutting interest rates and flooding their economies with monetary

stimulus. All this money sloshing around had to end up somewhere – and some of

it might have found its way into hard assets such as commodities, precious

metals, collectibles, and, yes, an Edvard Munch painting.

There’s something called the law of unintended consequences,

which means solving one problem might inadvertently create a new one. In this

case, the massive stimulus in recent years propped up the economy in the short

run, but it may have unintentionally masked the real problem and simply delayed

a day of reckoning.

With the following economic and political issues in play,

that day of reckoning may be nearing:

·

Eleven European countries have

experienced two consecutive quarters of economic contraction.

·

The unemployment rate across the

eurozone has matched a record high.

·

Job growth in the U.S. is slowing.

·

The Chinese economy is slowing.

·

The political situation in Greece is

chaotic.

·

France has a new Socialist

president.

Sources: MarketWatch, The

Wall Street Journal

Now, the good news. In any economic environment, there will

be winners and losers. As the steward of your financial life, we do everything

we can to try and help you land on the winning side regardless of what the

economy and markets throw in our way.

Weekly Focus – Think About It

“Nature is pleased with simplicity. And nature is no dummy.”

--Isaac

Newton, English physicist, mathematician, astronomer, natural

philosopher,

alchemist, theologian… yes, a really smart guy!

Value vs. Growth Investing (5/4/12)

|

-0.97

|

8.76

|

-0.81

|

1.11

|

2.37

|

17.31

|

0.57

|

|

|

-1.11

|

8.62

|

-1.02

|

1.73

|

4.11

|

15.99

|

0.14

|

|

|

-1.07

|

8.76

|

-0.63

|

1.53

|

4.85

|

15.51

|

1.64

|

|

|

-1.05

|

13.08

|

-2.45

|

3.12

|

9.35

|

19.43

|

2.68

|

|

|

-1.21

|

4.41

|

-0.04

|

0.62

|

-1.88

|

13.14

|

-4.08

|

|

|

-0.65

|

9.51

|

-0.27

|

-0.32

|

-1.74

|

20.68

|

1.29

|

|

|

-0.63

|

10.32

|

0.68

|

0.07

|

1.62

|

22.83

|

2.24

|

|

|

-1.02

|

10.50

|

-1.19

|

-0.60

|

-3.11

|

20.80

|

2.30

|

|

|

-0.30

|

7.79

|

-0.37

|

-0.45

|

-3.79

|

18.23

|

-0.97

|

|

|

-0.41

|

8.14

|

-0.02

|

-1.28

|

-3.56

|

20.67

|

1.99

|

|

|

-0.49

|

8.62

|

-0.10

|

-1.54

|

-5.71

|

19.80

|

0.77

|

|

|

-0.90

|

7.63

|

-0.58

|

-1.69

|

-3.94

|

20.34

|

2.73

|

|

|

0.12

|

8.10

|

0.56

|

-0.64

|

-0.91

|

21.77

|

2.16

|

|

|

-0.95

|

9.04

|

-0.35

|

1.04

|

3.49

|

17.34

|

1.86

|

|

|

-1.03

|

12.17

|

-2.08

|

2.02

|

5.79

|

19.85

|

2.67

|

|

|

-0.93

|

5.35

|

-0.06

|

0.31

|

-2.21

|

14.73

|

-2.99

|

©2004

Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is

proprietary to Morningstar; (2) is not warranted to be accurate, complete or

timely. Morningstar is not responsible for any damages or losses arising from

any use of this information and has not granted its consent to be considered or

deemed an “expert” under the Securities Act of 1933. Past performance is no

guarantee of future results. Indices are

unmanaged and while these indices can be invested in directly, this is neither

a recommendation nor an offer to purchase.

This can only be done by prospectus and should be on the recommendation

of a licensed professional.

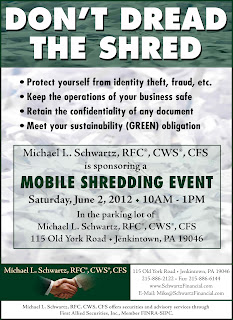

Office Notes:

Best

regards,

Michael L. Schwartz, RFC®, CWS®, CFS

P.S.

Please feel free to forward this commentary to family, friends, or

colleagues. If you would like us to add

them to the list, please reply to this email with their email address and we

will ask for their permission to be added.

Securities and advisory services

offered through First Allied Securities, Inc., Member

FINRA/SIPC

Schwartz Financial Service, Inc is

not an affiliate of First Allied Securities, Inc.

This

information is provided for informational purposes only and is not a

solicitation or recommendation that any particular investor should purchase or

sell any security. The information contained herein is obtained from sources

believed to be reliable but its accuracy or completeness is not

guaranteed. Any opinions expressed

herein are subject to change without notice.

An Index is a composite of securities that provides a performance

benchmark. Returns are presented for

illustrative purposes only and are not intended to project the performance of

any specific investment. Indexes are

unmanaged, do not incur management fees, costs and expenses and cannot be

invested in directly. Past

performance is not a guarantee of

future results.

* The Standard & Poor's 500 (S&P

500) is an unmanaged group of securities considered to be representative of the

stock market in general.

* The DJ Global ex US is an unmanaged group

of non-U.S. securities designed to reflect the performance of the global equity

securities that have readily available prices.

* The 10-year Treasury Note represents debt

owed by the United States Treasury to the public. Since the U.S. Government is

seen as a risk-free borrower, investors use the 10-year Treasury Note as a

benchmark for the long-term bond market.

* Gold represents the London afternoon gold

price fix as reported by the London Bullion Market Association.

* The DJ Commodity Index is designed to be

a highly liquid and diversified benchmark for the commodity futures market. The

Index is composed of futures contracts on 19 physical commodities and was

launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures

the total return performance of the equity subcategory of the Real Estate

Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any

reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change

without notice and are not intended as investment advice or to predict future

performance.

* Past performance does not guarantee

future results.

* You cannot invest directly in an index.

* Consult your financial professional

before making any investment decision.

* To unsubscribe from our “market commentary” please reply to this e-mail

with “Unsubscribe” in the subject

line, or write us at “mike@schwartzfinancial.com”.